India LEI Requirements

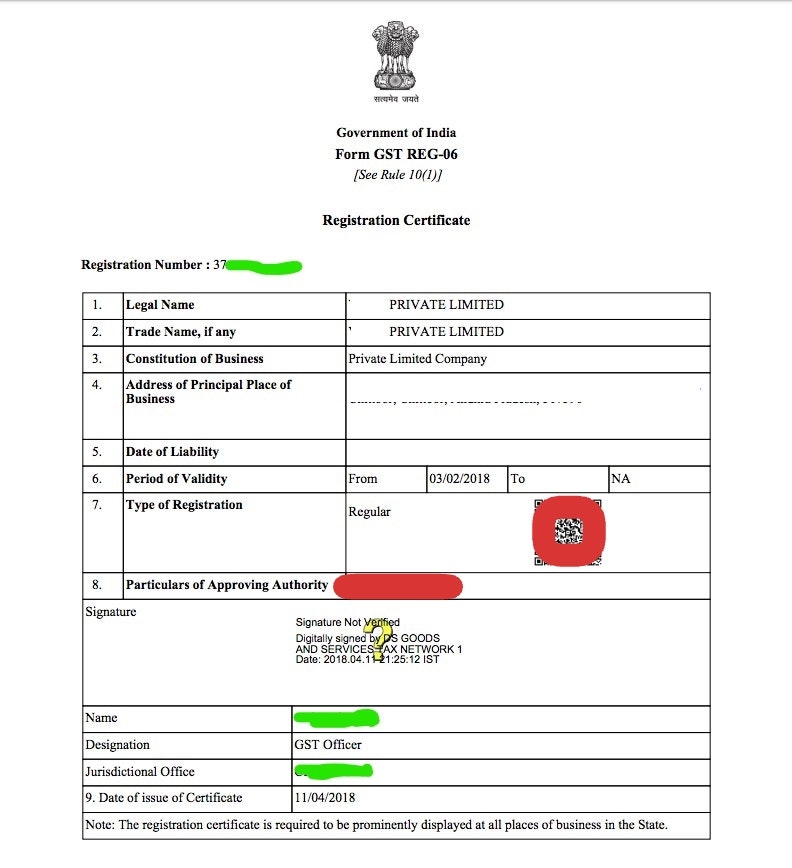

Each Legal Entity Identifier application must go through a validation process. Please upload a document which confirms the following:

Legal name (and trading name)

Company number e.g CIN, GSTIN, IEC or equivalent

Legal registered address

Name of Authorised Signatory (company representative e.g Director, Board Member)

Date of Incorporation

Examples of documents required for LEI in India:

Examples include Certificate of Incorporation, GST REG-06 with annexure B, IEC details. A PAN card is necessary for Partnerships (LLPs), Trusts, and societies.

Entity type | Documents required |

|---|---|

Partnership | GST Certificate · Partnership deed AND Pan · IEC · UDYAM |

Private Limited / Limited / LLP | Certificate of Incorporation · GST Certificate · IEC Certificate (ANY ONE) |

Trust | GST Certificate & PAN · Trust deed & PAN · NGO Darpan (ANY ONE) |

Society / NGO / Foundation / AOP / Academic Institution | GST Certificate & PAN · NGO Darpan Certificate · UDYAM Certificate & Bye Laws |

Bank | GST Certificate & PAN · RBI license with Board Resolution & PAN |

Sole Proprietorship | GST Certificate · IEC · UDYAM (all pages) (ANY ONE) |

HUF | GST Certificate & PAN · UDYAM Certificate & Member list |

Fund / Scheme | DEED & Board Resolution & PAN |

Others | Any document proving the company’s name, address and authorized signatory’s name in the online register will suffice. |